3 Easy Facts About Amur Capital Management Corporation Shown

Wiki Article

Our Amur Capital Management Corporation Ideas

Table of ContentsFacts About Amur Capital Management Corporation RevealedThe Best Guide To Amur Capital Management CorporationThe Of Amur Capital Management CorporationAmur Capital Management Corporation Can Be Fun For EveryoneSome Of Amur Capital Management CorporationFacts About Amur Capital Management Corporation Revealed

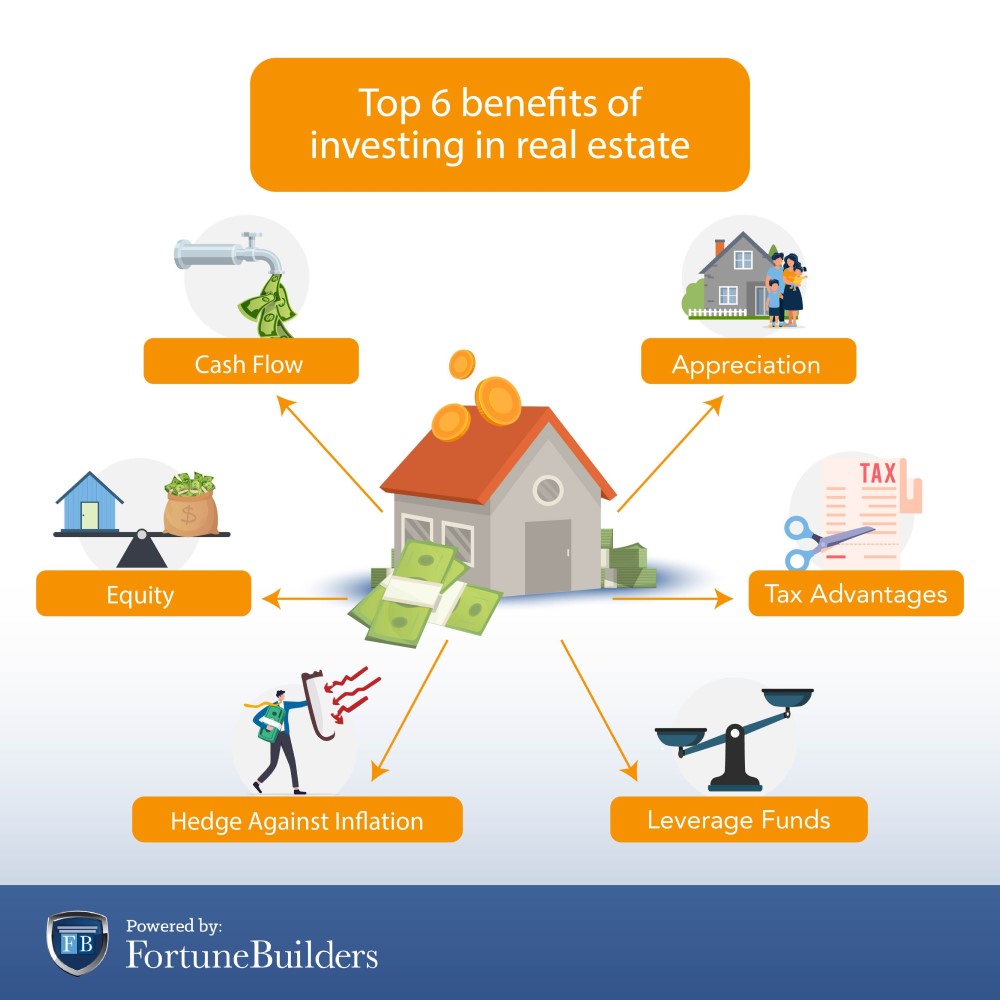

Not just will the home rise in worth the longer you have it, but rental rates usually comply with an upward trend also. This materializes estate a rewarding long-term investment. Real estate investing is not the only way to spend. There are lots of other financial investment choices readily available, and each features its very own set of toughness and weaknesses.

The 20-Second Trick For Amur Capital Management Corporation

Savvy investors might be rewarded in the type of recognition and dividends. As a matter of fact, since 1945, the typical huge stock has returned near to 10 percent a year. Stocks really can function as a long-term savings automobile. That stated, supplies might just as easily diminish. They are by no indicates a certainty.That stated, actual estate is the polar opposite regarding particular elements. Web earnings in real estate are reflective of your own actions.

Stocks and bonds, while usually abided with each other, are essentially various from one another. Unlike stocks, bonds are not rep of a stake in a business.

Some Known Factual Statements About Amur Capital Management Corporation

The real advantage property holds over bonds is the time framework for holding the financial investments and the price of return during that time. Bonds pay a fixed interest rate over the life of the investment, therefore acquiring power with that said passion goes down with rising cost of living gradually (mortgage investment corporation). Rental home, on the other hand, can generate greater leas in periods of greater rising cost of living

It is as straightforward as that. There will always be a need for the rare-earth element, as "Fifty percent of the globe's population relies on gold," according to Chris Hyzy, primary financial investment officer at united state Depend on, the exclusive wide range administration arm of Financial institution of America in New York City. According to the World Gold Council, need softened in 2015.

Amur Capital Management Corporation Can Be Fun For Everyone

Acknowledged as a reasonably safe commodity, gold has established itself as an automobile to raise financial investment returns. Some don't even think about gold to be a financial investment at all, rather a hedge against rising cost of living.Obviously, as secure as gold might be considered, it still stops working to stay as appealing as realty. Below are a few reasons financiers like property over gold: Unlike actual estate, there is no funding and, therefore, no room to leverage for growth. Unlike realty, gold proposes no tax obligation benefits.

Everything about Amur Capital Management Corporation

When the CD matures, you can collect the original investment, along with some rate of interest. Deposit slips do not appreciate, and they have actually had a historical average return of 2.84 percent in the last eleven years. Actual estate, on the other hand, can value. As their names suggest, mutual funds contain financial resources that have actually been pooled with each other (mortgage investment).It is just one of the easiest ways to expand any kind of profile. A shared fund's performance is constantly measured in terms of overall return, or the amount of the change in a fund's net possession worth (NAV), its rewards, and its capital gains distributions over a provided amount of time. However, similar to stocks, you have little control over the efficiency of your properties. https://amurcapitalmc.edublogs.org/2024/04/06/unlocking-investment-potential-amur-capital-management-corporation/.

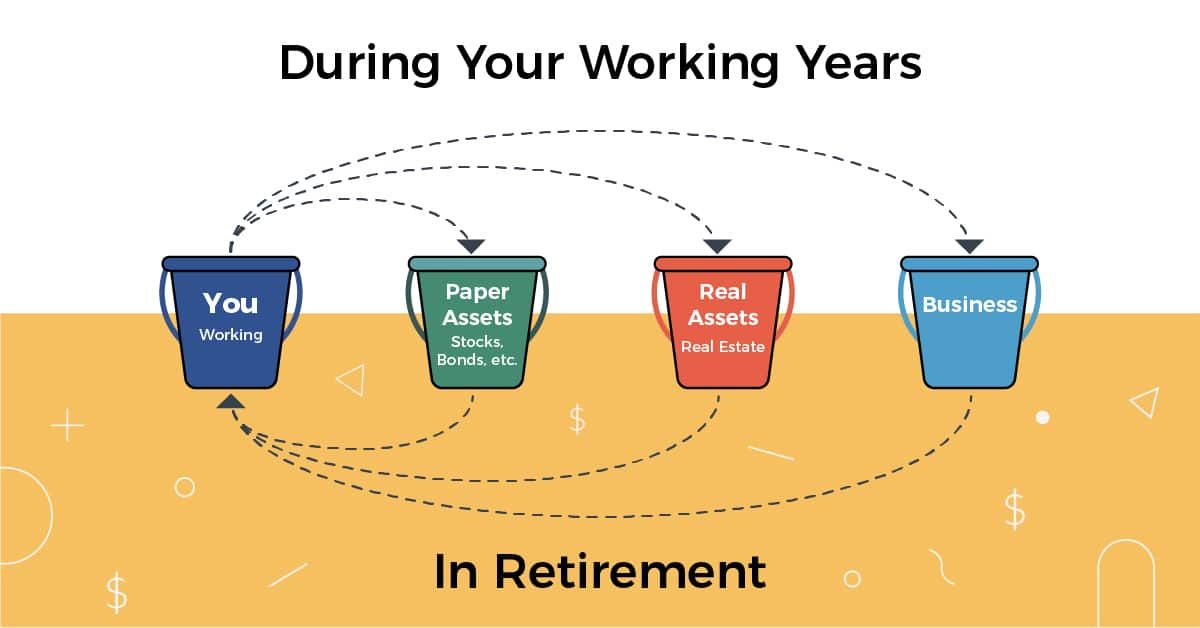

In fact, putting cash right into a mutual fund is essentially handing one's financial investment choices over to a professional cash supervisor. While you can decide on your investments, you have little state over exactly how they execute. The 3 most common methods to purchase genuine estate are as adheres to: Buy And Hold Rehab Wholesale With the worst part of the economic downturn behind us, markets have actually undergone historic appreciation rates in the last three years.

The Basic Principles Of Amur Capital Management Corporation

Purchasing low doesn't indicate what it utilized to, and financiers have recognized that the landscape is transforming. The spreads that dealers and rehabbers have become familiar with are starting to create memories of 2006 when worths were traditionally high (investment). Certainly, there are still numerous possibilities to be had in the click resources world of flipping property, but a brand-new departure method has become king: rental buildings

Or else understood as buy and hold homes, these homes feed off today's appreciation prices and take advantage of on the fact that homes are much more pricey than they were just a couple of short years back. The concept of a buy and hold leave method is easy: Financiers will aim to enhance their lower line by renting the residential property out and collecting month-to-month cash flow or merely holding the home till it can be sold at a later date for an earnings, of course.

Report this wiki page